Archived - Aboriginal Affairs and Northern Development Canada - Quarterly Financial Report (Revised) - For the quarter ended September 30, 2014

Archived information

This Web page has been archived on the Web. Archived information is provided for reference, research or record keeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Erratum

Date: December 16, 2014

Location: Table 2 Departmental Budgetary Expenditures by Standard Object (unaudited), Fiscal year 2013-2014, Year to Date used at quarter-end, Personnel

Revisions: "$242,473" replaces "120,074"

Rationale for the revision: The Chief Financial Officer and Deputy Minister approved document was not correctly reflected in the original web version

1. Introduction

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. It should be read in conjunction with the Main Estimates and Supplementary Estimates (A) for fiscal year 2014-2015 as well as Canada’s Economic Action Plan 2014 (Budget 2014). For purposes of both the Main and Supplementary Estimates, the Department is referred to as Indian Affairs and Northern Development.

The quarterly financial report has not been subject to an external audit or review.

1.1 Authority, Mandate and Program Activities

Aboriginal Affairs and Northern Development Canada (AANDC) supports Aboriginal people (First Nations, Inuit and Métis) and Northerners in their efforts to:

- Improve social well-being and economic prosperity;

- Develop healthier, more sustainable communities; and

- Participate more fully in Canada’s political, social and economic development – to the benefit of all Canadians.

Further details on AANDC’s authority, mandate and program activities can be found in Part II of the Main Estimates and the Report on Plans and Priorities.

1.2 Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting and a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities. The accompanying Statement of Authorities includes AANDC’s spending authorities granted by Parliament and those used by the Department consistent with the Main Estimates and Supplementary Estimates (A) as well as the Operating Budget Carry Forward and the Capital Budget Carry Forward for the 2014-2015 fiscal year.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.3 AANDC’s Financial Structure

The parliamentary vote structure of AANDC is made up of $8.4 billion in budgetary authorities of which $8.2 billion requires approval by Parliament; referred to as voted amounts. The remaining $181.3 million represents statutory authorities that do not require additional approval and are provided for information purposes.

Voted amounts totalling $8.2 billion are split between Operating Expenditures, Capital Expenditures and Grants and Contributions as follows:

- Operating Expenditures represents approximately $1.4 billion (16.4 percent) - which includes $519.4 million (6.3 percent) for the Settlement Allotment (Independent Assessment Process and Alternative Dispute Resolution) and $124.8 million (1.5 percent) for the assessment, management and remediation of federal contaminated sites.

- Capital represents approximately $18.9 million (0.2 percent).

- Grants and Contributions represent approximately $6.9 billion (83.4 percent).

More detailed information about AANDC's financial structure, including information about the fiscal cycle, cost drivers, expenditure trends, etc. can be found in the 2014-15 Financial Overview - July 2014.

2. Highlights of fiscal quarter and fiscal year to date (YTD) results

This section highlights the significant items that contributed to the net increase or decrease in resources available for the year and actual expenditures for the quarter ended September 30, 2014. The explanation of variances considers that changes under five percent would have minimal impact on interpretation of results.

2.1 Statement of Authorities (Table 1)

The Quarterly Financial Report reflects the year over year change in authorities for the period April 1 to September 30, 2014. Total year-to-date authorities available for use in the second quarter of 2014-2015 were $8,486.0 million compared to $8,141.1 million for the same quarter of the prior year, representing an increase in Departmental Authorities of $344.9 million. The total 2014-2015 year-to-date authority increase of $344.9 million over 2013-2014 can be explained as follows:

| Program | Increase/(Decrease) in Authorities Available For Use ($ millions) | ||||||

|---|---|---|---|---|---|---|---|

| Budgetary | Non-Budgetary | Total | |||||

| Vote 1Operating | Vote 5 Capital | Vote 10 Grants and Contributions | Statutory - Operating | Statutory – Grants and Contributions | |||

| a. Net increase in the cash flow for the negotiation, settlement and implementation of specific and comprehensive claims (primarily for the continued implementation of Justice at Last: Specific Claims Action Plan) | 26.2 | (6.0) | 285.5 | 0.5 | 1.8 | 308.0 | |

| b. Increase in funding to meet increased demand for ongoing Indian and Inuit programs which reflects a 2% allowance for inflation and population growth and provides access to basic services such as education, housing, community infrastructure (water and sewage systems), and social support services | 0.3 | 102.6 | 102.9 | ||||

| c. Increase in funding pursuant to funding approved in Economic Action Plan 2012 to support the construction and/or renovation of schools on reserves | 33.0 | 33.0 | |||||

| d. Increase in funding for the renewal of Gas Tax Funding | 26.7 | 26.7 | |||||

| e. Other various initiatives (net)* | (14.2) | 8.6 | 14.2 | (1.9) | 6.7 | ||

| f. Decrease in funding for the assessment, management and remediation of federal contaminated sites | (34.5) | 14.3 | (20.2) | ||||

| g. Decrease in funding for the Indian Residential Schools Settlement Agreement including funding for awards to claimants resulting from the Independent Assessment Process and Alternative Dispute Resolution as well as funding for the administration and research required to support the federal government’s obligations under the agreement | (52.1) | (0.1) | (52.2) | ||||

| h. Decrease in funding reflecting the savings identified as part of the Economic Action Plan 2012 Spending Review | (30.8) | (69.7) | (4.9) | (105.4) | |||

| 1st Qtr - Total increase / (decrease) to Departmental Authorities | (105.1) | 2.6 | 379.9 | (6.4) | 28.5 | 0.0 | 299.5 |

| i. Operating Budget Carry Forward | 42.8 | 42.8 | |||||

| j. Capital Budget Carry Forward | 2.6 | 2.6 | |||||

| 2nd Qtr - Total increase / (decrease) to Departmental Authorities | (62.3) | 5.2 | 379.9 | (6.4) | 28.5 | 0.0 | 344.9 |

| This net funding profile change includes an increase in funding for the Family Violence Prevention Program, First Nations Land and Management Regime and post-secondary education for First Nations and Inuit students & business studies by Aboriginal students; and a decrease in funding for Maa-nulth First Nation and Canadian High Arctic Research Station. | |||||||

- As shown in the table above, the $344.9 million increase in total authorities is primarily attributed to the decrease of $62.3 million in Operating expenditures authority and the increase of $379.9 million in Grants and Contributions authority.

- The decrease of $62.3 million in Operating expenditures authority is primarily due to a decrease of funding for the Indian Residential Schools Settlement Agreement ($52.1M), the assessment, management and remediation of federal contaminated sites ($34.5M) and the savings identified as part of the Budget 2012 Spending Review ($30.8M). This decrease is partially offset by the increase in funding for claims activities ($26.2M) and the Operating Budget Carry Forward which was received during the second quarter of 2014-15 ($42.8M).

- The increase of $379.9 million in Grants and Contributions authority is primarily due to an increase in funding for claims activities ($285.5M), ongoing Indian and Inuit programs providing access to basic services ($102.6M) and initiatives to support the construction and/or renovation of schools on reserves ($33M). This increase is partially offset by the savings identified as part of the Budget 2012 Spending Review ($69.7M).

2.2 Statement of Departmental Budgetary Expenditures by Standard Object (Table 2)

Highlights of Fiscal Quarter ended September 30, 2014

The Department is estimating budgetary expenditures of $8.4 billion in 2014-2015. In the second quarter, 17.9% of total available authorities were expended for which departmental expenditures were $100.5 million lower than the same period in 2013-2014. Year to date expenditures account for 39.5% of the total available authorities. The decrease in expenditure activity can be attributed mainly to a decrease of $99.9 million in Grant and contribution expenditures, $7.7 million in Operating expenditures, and offset by an increase of $5.1 million in Capital expenditures as indicated in table one.

Reduced spending in the second quarter of 2014-2015 is largely attributed to a decrease in Transfer payments (standard object 10) of $95.8 million which is mainly related to timing of payments. The Department was able to advance the funding cycle in 2014-2015 and finalize agreements and issue more funds to recipients earlier in the first quarter of the fiscal year. There was also a reduction of contribution expenditures under Emergency Management Assistance in the second quarter of 2014-2015.

Personnel (standard object 1) saw a reduction by $7.9 million in 2014-2015 which is primarily related to funds transfered to the Northwest Territories as part of Northwest Territories Devolution on April 1, 2014, and decreases related to the employer’s contribution to the Public Service Pension Plan.

Other subsidies and payments (standard object 12) were reduced by $3.8 million in 2014-2015 which is related to various items such as the timing of Indian Residential School settlements, including associated legal fees and disbursements.

Professional and special services (standard object 4) saw an increase by $6.4 million in 2014-2015 primarily due to contracts related to the construction of the Canadian High Arctic Research Station.

3. Risks and Uncertainties

Expenditures as of September 30, 2014

($ millions)

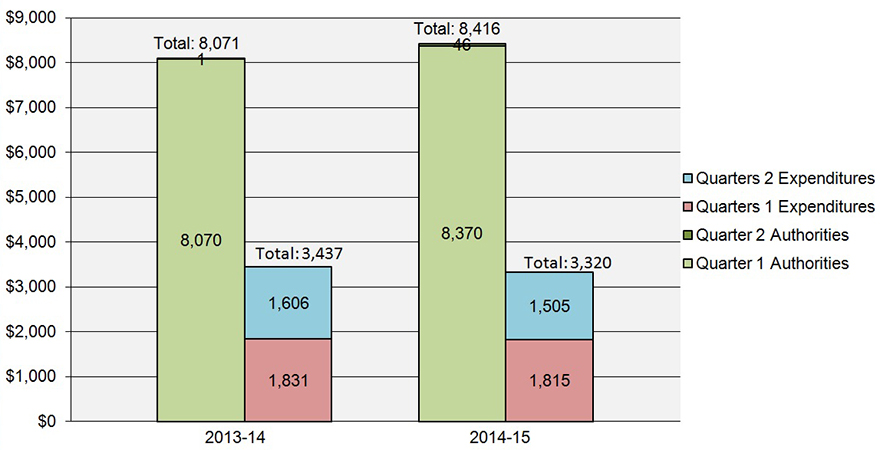

Text description of Year-to-Date Comparison of Budgetary Authorities and Expenditures as of September 30, 2014

This image is of a bar graph of the year-to-date comparison of budgetary authorities and expenditures as of the end of September 30, 2014. The graph plots the authorities and expenditures by quarter arriving at a year to date total for the fiscal years 2013-14 and 2014-15.

The 2013-14 data shows the Q2 authorities equaling the Main Estimates, the Supplementary Estimates A authorities and the Operating and Capital Budget Carry Forwards arriving at the total authority at the end of Q1 of $8,141M. The 2014-2015 data shows the Q2 authorities equaling the Main Estimates and the Supplementary Estimates A authorities arriving at the total authority at the end of Q2 of $8,486M.

The net difference in comparing the authorities at the end of Q2 each fiscal year is an increase of $345M from 2013-14 to 2014-15.

The second column of each section of the graph pertains to expenditures. The 2013-14 data shows the Q1 expenditures of $1,831 and the Q2 expenditures of $1,606M. The 2014-15 data shows the Q1 expenditures of $1,815M and the Q2 expenditures of $1,505M. The net difference in comparing the expenditures at the end of Q2 each fiscal year is a decrease of $104M from 2013-14 to 2014-15.

3.1 Risks and Uncertainties

Risk management and risk-based decision-making have become a critical component in the way the Department prioritizes and conducts its business. Resource allocation decisions are informed by risk and the Department’s key corporate risks are discussed systematically by the senior management committee, which contributes to the better allocation of resources and ultimately better results.

In terms of financial risk, the Department is operating in an environment of diminished operating resources in which the ability to reallocate resources internally is reduced. The Department continues to monitor its risk exposure and take action as needed to mitigate the risk of not achieving anticipated outcomes or to deal with emerging pressures. Achievement of AANDC’s strategic outcomes and delivery of programs is dependent on timely access to appropriate authorities and funding levels.

In terms of transfer payment program and transfer payment recipient risk, the Department transfers over $6 billion dollars to recipients each year, while balancing program and recipient risks to deliver on its mandate. The Department undertakes risk assessments on new, existing and reformed programs as well as an annual General Assessment of each recipient to identify certain areas at risk as history has substantiated a link between risk level and default prevention.

3.2 Risk Mitigating Strategies

Corporate and financial risk mitigation activities are reflected in the Department’s Corporate Business Plan and are monitored by senior management on a quarterly basis and modified as required. A number of practices and internal controls help to manage risk departmentally, including senior management governance and oversight as established through committees, existing policies and procedures that ensure an appropriate level of monitoring, review and reporting.

The Department is addressing reduced flexibility to its budget as a result of expenditure restraint measures by aligning resources to needs and through rigorous monitoring against both financial and human resource targets. Management proactively and systematically manages and responds to risks to minimize adverse impacts and capitalize on opportunities. For example, cost containment measures and expenditure trends are monitored monthly, including a review and challenge function, through the monthly Financial Status Report.

In order to ensure effective controls, transparency and accountability, a risk-based approach is used to confirm that recipients have met planned program outcomes and results; that they are in compliance with funding agreements; and, that the funds were used to the intended purposes. In addition, the ability to conduct audits of recipients, under the terms of their funding agreements; provide a further opportunity to ensure that First Nations have appropriate management, financial and administrative controls in place.

4. Significant changes in relation to Operations, Personnel and Programs

Significant changes in relation to Operations, Personnel and Programs during the first quarter of fiscal year 2014-15 include:

- Colleen Swords was appointed as Deputy Minister, Aboriginal Affairs and Northern Development Canada, effective July 21, 2014.

5. Budget 2012 Implementation

This section provides an update of the savings measures announced in Budget 2012 that are being implemented in order to refocus government and programs; make it easier for Canadians and business to deal with their government; and modernize and reduce the back office.

Aboriginal Affairs and Northern Development Canada achieved savings of $24.4 million in the first year (2012-2013). Savings increased to $55.1 million in 2013-2014 and resulted in ongoing savings of $160.6 million commencing in 2014-2015.

There are no significant financial risks related to Budget 2012 savings for this quarterly financial report. AANDC continues to manage the implementation of Budget 2012 savings through its financial management and monitoring processes.

In the second quarter, the Department focused on ensuring that outstanding savings measures were fully implemented. These saving measures consist of a series of operational changes to be implemented to deliver efficient, effective and accountable programs to Aboriginal people and Northerners. The Department finalized the implementation of four saving measures and another, with a minor outstanding milestone, remains to be closed. A final report will be completed once all saving measures have been completed. Furthermore, the Department’s Implementation Committee, responsible for oversight of Budget 2012 Implementation, held its final meeting with respect to Budget 2012 initiatives in the second quarter and management of current and future change initiatives was transferred to the Human Resources Workplace Services and Management Committee.

6. Approval by Senior Officials

Approved, as required by the Treasury Board Policy on Financial Resource Management, Information and Reporting:

‹original signed by›

__________________________

Colleen Swords

Deputy Minister

Date: November 26, 2014

City: Gatineau

‹original signed by›

__________________________

Paul J. Thoppil, C.A.

Chief Financial Officer

Date: November 25, 2014

City: Gatineau

Statement of Authorities (unaudited) - Table 1

(thousands of dollars)

| Fiscal year 2014-2015 | Fiscal year 2013-2014 | Variances | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Vote | Total available for use for the year ending March 31, 2015* | Used during the quarter ended September 30, 2014 | Year to date used at quarter-end | Total available for use for the year ending March 31, 2014* | Used during the quarter ended September 30, 2013 | Year to date used at quarter-end | Authority | Qtr | YTD |

| 1 Operating expenditures | 1,352,049 | 290,489 | 477,408 | 1,414,329 | 298,192 | 508,006 | (62,280) | (7,703) | (30,598) |

| 5 Capital expenditures | 18,926 | 6,132 | 6,649 | 13,683 | 1,032 | 1,449 | 5,243 | 5,100 | 5,200 |

| 10 Grants and contributions | 6,863,465 | 1,167,925 | 2,741,962 | 6,483,588 | 1,267,882 | 2,836,356 | 379,877 | (99,957) | (94,394) |

| (S) Budgetary statutory authorities - Operating Expenditures | |||||||||

| Contributions to employee benefit plans | 63,838 | 15,324 | 30,649 | 70,304 | 17,576 | 35,152 | (6,466) | (2,252) | (4,503) |

| Minister of Aboriginal Affairs and Northern Development – Salary and motor car allowance | 80 | 40 | 40 | 79 | 20 | 36 | 1 | 20 | 4 |

| Payments to comprehensive claim beneficiaries in compensation for resource royalties | 2,622 | 2,768 | 3,486 | 2,606 | - | 674 | 16 | 2,768 | 2,812 |

| Liabilities in respect of loan guarantees made to Indians for Housing and Economic Development | 2,000 | 10 | 10 | 2,000 | - | - | 0 | 10 | 10 |

| Grassy Narrows and Islington Bands Mercury Disability Board | 15 | - | - | 15 | - | - | 0 | 0 | 0 |

| Other | - | 1,994 | 4,832 | 0 | 1,655 | 1,955 | 0 | 339 | 2,877 |

| (S) Budgetary statutory authorities - Transfer Payments: | |||||||||

| Grants to Aboriginal organizations designated to receive claim settlement payments pursuant to Comprehensive Land Claim Settlement Acts | 75,611 | 20,581 | 52,663 | 73,762 | 19,671 | 51,746 | 1,849 | 910 | 917 |

| Grant to the Nunatsiavut Government for the implementation of the Labrador Inuit Land Claims Agreement pursuant to theLabrador Inuit Land Claims Agreement Act | 8,994 | - | - | 8,994 | - | - | 0 | 0 | 0 |

| Indian Annuities Treaty payments | 1,400 | (110) | 2,364 | 1,400 | (339) | 1,783 | 0 | 229 | 581 |

| Contributions in connection with First Nations infrastructure | 26,731 | - | - | - | - | - | 26,731 | 0 | 0 |

| Total Budgetary Authorities | 8,415,731 | 1,505,153 | 3,320,063 | 8,070,760 | 1,605,689 | 3,437,157 | 344,971 | (100,536) | (117,094) |

| Non-Budgetary Authorities | |||||||||

| Loans to native claimants | 39,903 | 3,596 | 6,399 | 39,903 | 4,397 | 5,077 | 0 | (801) | 1,322 |

| Loans to First Nations in British Columbia for the purpose of supporting their participation in the British Columbia Treaty Commission Process | 30,400 | 6,411 | 8,105 | 30,400 | 8,926 | 9,751 | 0 | (2,515) | (1,646) |

| Total Non-Budgetary Authorities | 70,303 | 10,007 | 14,504 | 70,303 | 13,323 | 14,828 | 0 | (3,316) | (324) |

| Total Authorities | 8,486,034 | 1,515,160 | 3,334,567 | 8,141,063 | 1,619,012 | 3,451,985 | 344,971 | (103,853) | (117,418) |

| *Including only Authorities available for use and granted by Parliament at quarter-end. | |||||||||

Departmental Budgetary Expenditures by Standard Object (unaudited) - Table 2

(thousands of dollars)

| Fiscal year 2014-2015 | Fiscal year 2013-2014 | Variances | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2015 | Expended during the quarter ended September 30, 2014 | Year to date used at quarter-end | Planned expenditures for the year ending March 31, 2014 | Expended during the quarter ended September 30, 2013 | Year to date used at quarter-end | Planned | Qtr | Qtr | |

| Expenditures: | |||||||||

| 1 Personnel | 447,772 | 112,178 | 220,206 | 474,431 | 120,074 | 242,473 | (26,659) | (7,896) | (22,267) |

| 2 Transportation and communications | 41,981 | 6,942 | 8,465 | 40,699 | 5,740 | 9,330 | 1,282 | 1,202 | (865) |

| 3 Information | 20,193 | 2,847 | 3,227 | 17,728 | 3,204 | 4,029 | 2,465 | (357) | (802) |

| 4 Professional and special services | 343,623 | 50,017 | 60,341 | 344,668 | 43,654 | 59,834 | (1,045) | 6,363 | 507 |

| 5 Rentals | 19,109 | 3,224 | 3,279 | 10,460 | 2,548 | 3,697 | 8,649 | 676 | (418) |

| 6 Purchased repair and maintenance | 3,606 | 444 | 456 | 3,521 | 261 | 318 | 85 | 183 | 138 |

| 7 Utilities, materials and supplies | 8,738 | 929 | 977 | 7,309 | 966 | 1,357 | 1,429 | (37) | (380) |

| 8 Acquisition of land, buidlings and works | 14,303 | 53 | 53 | 6,639 | 4 | 4 | 7,664 | 49 | 49 |

| 9 Acquisition of machinery and equipment | 2,992 | 431 | 461 | 20,000 | 1,503 | 1,682 | (17,008) | (1,072) | (1,221) |

| 10 Transfer payments | 6,976,200 | 1,188,854 | 2,797,448 | 6,567,744 | 1,284,656 | 2,859,389 | 408,456 | (95,802) | (61,941) |

| 11 Public debt charges | - | - | - | - | - | - | 0 | 0 | 0 |

| 12 Other subsidies and payments | 537,924 | 139,234 | 225,150 | 578,311 | 143,079 | 255,044 | (40,387) | (3,845) | (29,894) |

| Total gross budgetary expenditures | 8,416,441 | 1,505,153 | 3,320,063 | 8,071,510 | 1,605,689 | 3,437,157 | 344,931 | (100,536) | (117,094) |

| Less: Revenues netted against expenditures | |||||||||

| Internal Services | (710) | - | - | (750) | - | - | 40 | 0 | 0 |

| Total Revenues netted against expenditures | (710) | - | - | (750) | - | - | 40 | 0 | 0 |

| Total net budgetary expenditures | 8,415,731 | 1,505,153 | 3,320,063 | 8,070,760 | 1,605,689 | 3,437,157 | 344,971 | (100,536) | (117,094) |

| * The total expenditures for Personnel for the fiscal year 2013-2014 for the year to date used at quarter-end has been updated to reflect the amount of $242,473 thousands. | |||||||||