Calculating Royalty

Royalty rates for frontier lands are specified in the Frontier Lands Petroleum Royalty Regulations. Royalty is payable by each individual interest holder of a production licence in a project. Interest holders are required to submit monthly royalty returns and pay a royalty on their monthly production. For detailed instructions on how royalty is calculated, please refer to the submission guides for the monthly royalty return and monthly production and cost statement.

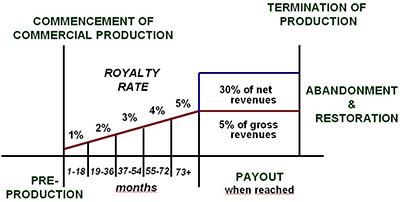

Payout status is key in determining royalty rates. Payout is a measure of when an interest holder has recovered the cost of their initial investment in a project, including a specified return allowance. Prior to "project payout", royalties of 1% of gross revenues are payable for the first 18 months of production, increasing by 1% every 18 months to a maximum of five percent. After recovery of initial investment (i.e. payout) royalty is the greater of 5% of gross revenues or 30% of net revenues.

Project Life Cycle

Description of Project life cycle

The 1%-5% royalty rate is charged in the pre-payout phase of a project. Once the project reaches payout, the royalty rate becomes either 30% of net or 5% of gross revenues - whichever is greater.

Pre-production Licence Costs

For the purposes of computing project payout, costs incurred prior to project commencement are indexed to inflation from the date they were incurred to the date of project commencement

Payout Status

Payout is reached the first month in which the interest holder's cumulative gross revenues from a project are equal to or greater than the interest holder's cumulative costs for that project.

Cumulative costs include allowed capital costs, allowed operating costs, 1% capital cost adjustment, 10% operating cost adjustment, royalty paid, and a return allowance.

Return Allowance

The return allowance is calculated for every month following project commencement up to, but not including, the month of payout. The return allowance is generally equal to 10% plus the long-term bond rate applied to the interest holder's payout balance.

Gross Revenues

Gross revenues of an interest holder in a project are the revenues in a month from petroleum produced from project lands less allowed gas processing and transportation allowances.

Net Revenues

Net revenues of an interest holder in a project are equal to gross revenues for the month minus the aggregate of allowed capital costs, allowed operating costs, 1% capital cost adjustment, and 10% operating cost adjustment.